sales tax in san antonio texas calculator

There is base sales tax by Texas. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

7914 Andrews Pass San Antonio Tx 78254 Realtor Com

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

. In part to make up for its lack of a state or local income tax sales and property taxes in Texas tend to be high. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Sales tax in San Antonio Texas is currently 825.

In Texas prescription medicine and food seeds are exempt from taxation. You can find more tax rates and allowances for San Antonio and Texas in the 2022 Texas Tax Tables. There is no applicable county tax.

Mailing Address The Citys PO. The County sales tax rate is. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

Did South Dakota v. Enter your info to see your take home pay. Calculator for Sales Tax in the San Antonio.

The San Antonio sales tax rate is. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. San Antonio collects the maximum legal local sales tax.

The average cumulative sales tax rate in San Antonio Texas is 822. PersonDepartment. What is the sales tax rate in San Antonio Texas.

A sales tax is a consumption tax paid to a government on the sale of. Sales and Use Tax. The minimum combined 2022 sales tax rate for San Antonio Texas is.

The results are rounded to two decimals. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was.

San antonio taxi rates from downtown. Before-tax price sale tax rate and final or after-tax price. While texas statewide sales tax rate is a relatively.

Within San Antonio there are around 82 zip codes with the most populous zip code being 78245. The December 2020 total local sales tax rate was also 8250. Sales Tax Calculator Sales Tax Table.

The Florida sales tax rate is currently. The minimum combined 2022 sales tax rate for San Antonio Florida is. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. For additional information see our Call Tips and Peak Schedule webpage. What is the sales tax rate in San Antonio Florida.

Fill in price either with or without sales tax. If this rate has been updated locally please contact us and we will update the sales tax rate for San. Use our sales tax calculator or download a free Texas sales tax rate table by zip code.

Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. To make matters worse rates in most major cities reach this limit. 2022 cost of living calculator for taxes.

The minimum combined 2021 sales tax rate for san antonio texas is. 0125 dedicated to the City of San Antonio Ready to Work. Texas Sales Tax.

0250 san antonio atd advanced transportation district. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes. Counties cities and districts impose their own local taxes. San Antonio has parts of it located within Bexar County and Comal County.

Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. The current total local sales tax rate in san antonio tx is 8250. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

The San Antonio sales tax rate is. So your big Texas paycheck may take a hit when. The County sales tax rate is.

Real property tax on median home. The sales tax added to the original purchase price produces the total cost of the purchase. The Texas sales tax rate is currently.

The current total local sales tax rate in San Antonio TX is 8250. San Antonio is located. The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San Antonio Texas Sales Tax Comparison Calculator for 202122.

This is the total of state county and city sales tax rates. The current total local sales tax rate in San Antonio TX is 8250. City of San Antonio Attn.

Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. Vermont has a 6 general sales tax but an. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts.

Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681 on top. Did South Dakota v. Sales Tax State Local Sales Tax on Food.

1000 City of San Antonio. San Antonios current sales tax rate is 8250 and is distributed as follows. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales.

The County sales tax rate is. And all states differ in their enforcement of sales tax. The minimum combined 2021 sales tax rate for San Antonio Texas is.

US Sales Tax Texas Bexar Sales Tax calculator San Antonio. The average cumulative sales tax rate in San Antonio Florida is 7. Box is strongly encouraged for all incoming mail.

San Antonio collects the maximum legal local sales tax. This is the total of state county and city sales tax rates. San Antonio TX 78205.

Sales Tax Calculator. This includes the rates on the state county city and special levels. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

While texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. 625 percent of sales price minus any trade-in allowance.

2417 Jupe Dr San Antonio Tx 78222 Realtor Com

225 Utah St San Antonio Tx 78210 Realtor Com

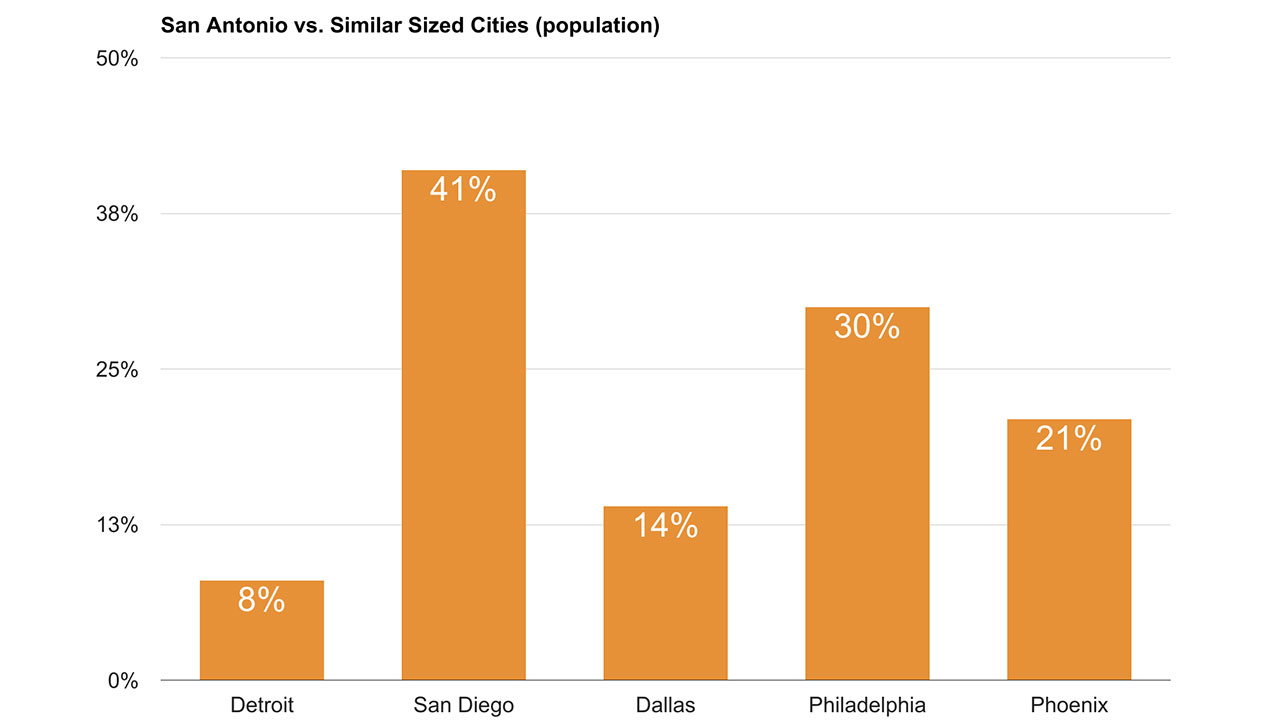

What Is The Cost Of Living In San Antonio Tx Movebuddha

547 Marquette Dr San Antonio Tx 78228 Realtor Com

13918 Mission Vly San Antonio Tx 78233 Realtor Com

Hotel Occupancy Tax San Antonio Hotel Lodging Association

7930 Maddie Ln San Antonio Tx 78255 Realtor Com

2119 Sacramento San Antonio Tx 78201 Realtor Com

9003 Village Dr San Antonio Tx 78217 Realtor Com

San Antonio Based Tech Company Says It Can Speed Up Homeowners Ability To Protest Property Taxes San Antonio News San Antonio San Antonio Current

Living In San Antonio 40 Things You Need To Know Before Moving Here Bhgre Homecity

726 Park Pt San Antonio Tx 78253 Realtor Com

9338 Regiment Dr San Antonio Tx 78240 Realtor Com

358 Kirk Pl San Antonio Tx 78225 Realtor Com

110 E Pyron Ave San Antonio Tx 78214 Realtor Com

4314 Anson Jones San Antonio Tx 78223 Realtor Com